NasdaqGS - Nasdaq Real Time Price • USD

T-Mobile US, Inc. (TMUS)

At close: April 26 at 4:00 PM EDT

After hours: April 26 at 7:44 PM EDT

All SEC Filings

Corporate Changes & Voting Matters

Periodic Financial Reports

Proxy Statements

Tender Offer/Acquisition Reports

Offering Registrations

-

-

-

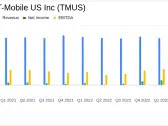

Q1 2024 T-Mobile US Inc Earnings Call

Q1 2024 T-Mobile US Inc Earnings Call

Thomson Reuters StreetEvents • 12 hours ago -

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Performance Overview

Trailing total returns as of 4/26/2024, which may include dividends or other distributions. Benchmark is S&P 500

| Return | TMUS | S&P 500 |

|---|---|---|

| YTD | +2.67% | +6.92% |

| 1-Year | +11.71% | +25.26% |

| 3-Year | +24.01% | +22.00% |