Stock market news live updates: Wall Street notches slim gains; Nasdaq, S&P 500 set new records

Wall Street rose on Friday, with stocks posting marginal new highs in thin, post-Thanksgiving trading, as hopes for a COVID-19 vaccine momentarily counterbalance soaring infection rates.

The New York Stock Exchange closed early for the Thanksgiving holiday. Stocks are consolidated their gains after the Dow Jones Industrial Average was catapulted above 30,000 for the first time ever on Tuesday, with an increasing number of investors encouraged by expectations that a vaccine will be rolled out by early next year, if not sooner.

“In the US, we expect the first available doses to go to high-risk groups from mid-December onwards, leading to significant public health benefits from [the first quarter of 2021] onwards, followed by widespread vaccination commencing in April,” Goldman Sachs economists wrote in a research note on Friday.

“While the exact timeline remains quite uncertain, this analysis reinforces our baseline forecast that widespread immunization should drive a sharp pickup in global growth starting in Q2,” the bank added.

As an indication of how investors are pricing in the upside, the CBOE Volatility Index (VIX) — the market’s “fear gauge” — briefly dipped below 20 on Friday, its lowest level in 9 months. The Dow (^DJI) closed below the critical 30,000 threshold, but is up more than 13% this month — more than 10,000 points higher than the multi-year low it breached in March, when panic over the virus’ spread cratered global markets.

Separately, the the S&P 500 (^GSPC), Nasdaq and the Russell 2000 (RUT) index also set fresh historic highs. Until recently, the technology-heavy Nasdaq has lagged other indexes as investors rotate out of “stay at home” stalwarts benefiting from coronavirus-related lockdowns.

Still, the backdrop to the current bull market is a spike in coronavirus infections that are acting as a drag on economic growth, and undermining a jobs recovery. Another 778,000 workers filed for unemployment benefits last week, underscoring how an implacable wave of COVID-19 infections are prompting states and cities to impose a new round of restrictions on public life.

Both the U.S. and Europe are global epicenters of the pandemic, yet major drugmakers have indicated that an inoculation is right around the corner.

A vaccine candidate from University of Oxford and AstraZeneca (AZN), which on Monday revealed that their candidate demonstrated efficacy of at least 70.4%, has since come under harsher scrutiny — prompting AstraZeneca to initiate a new trial. The company’s stock tumbled on Friday, as doubts about the data set in.

Separately, Pfizer (PFE) and BioNTech (BNTX) has filed for an emergency use authorization with the U.S. Food and Drug Administration, which would allow them to have their vaccine used in the U.S. starting in December.

—

1 p.m. ET: Stocks end busy week on a high note

Here’s where stocks finished Friday’s shortened session:

S&P 500 (^GSPC): 3,638.35, +8.70 (+0.24%)

Dow (^DJI): 29,910.37, +37.90 (+0.13%)

Nasdaq (^IXIC): 12,205.85, +111.44 (+0.92%)

Crude (CL=F): $45.35 per barrel, -$0.36 (-0.79%)

Gold (GC=F): $1,789.60 per ounce, -$21.60 (-1.19%)

10-year Treasury (^TNX): -0.036 bps to yield 0.8420%

—

12:30 p.m. Hot EV space gets a new player

QuantumScape (QS), a battery developer for electric vehicle use, began trading Friday on the NYSE. The company represents the convergence of two hot financial storylines: It’s an EV player (think Tesla) that’s the outgrowth of a SPAC merger. The stock skyrocketed by nearly 50% in early trading.

Founder and CEO Jagdeep Singh told Yahoo Finance Live in an interview that QuantumScape is “at the cusp for the beginning of this massive transformation” into the EV space.

—

12:00 p.m ET: Stocks adrift in quiet session, Dow shies away from 30K

Here were the main moves in markets as of noon ET:

S&P 500 (^GSPC): 3,636.70, +7.05 (+0.19%)

Dow (^DJI): 29,888.54, +16.07 (+0.05%)

Nasdaq (^IXIC): 12,202.17, +107.77 (+0.89%)

Crude (CL=F): $45.26 per barrel, -$0.45 (-0.98%)

Gold (GC=F): $1,783.80 per ounce, -$27.40 (-1.51%)

10-year Treasury (^TNX): flat to yield 0.8590%

—

10:30 a.m. ET: Adobe: Thanksgiving sales soar over 21%, hitting new record

So much for the theory that consumers getting weary, or feeling strapped by COVID-19: Adobe Analytics reported on Friday that Thanksgiving Day hit a new record with consumers spending $5.1B — a jump of over 21.5% year over year. With the boom of mobile shopping, nearly half of all web sales came from smartphones, also a new record.

But there was a slight catch:

‘While yesterday was a record-breaking Thanksgiving Day with over $5 billion spent online, it didn’t come with the kind of aggressive growth rate we’ve seen with the start of the pandemic. Heavy discounts and aggressive promotions starting in early November succeeded at getting consumers to open their wallets earlier. While COVID-19, the elections and uncertainty around stimulus packages impacted consumer shopping behaviors and made this an unprecedented year in ecommerce, many consumers are still holding off on remaining gift purchases until today and Cyber Monday in hopes of scoring the best deals.’

—

10:15 a.m. ET: Elon Musk beats Warren Buffett...sort of

Tesla’s (TSLA) relentless rally — the stock cruised to a new high early Friday — has given the electric car maker a market share that’s even bigger than Berkshire Hathaway (BRK), the massive holding company founded by legendary investor Warren Buffett.

Boom!

Tesla has just surpassed Berkshire Hatahaway in market cap at just over $550 billion. pic.twitter.com/hmwp13Samv— Brian Roemmele (@BrianRoemmele) November 27, 2020

Tesla’s market cap is currently north of $560 billion, the largest of any carmaker, while Berkshire’s is $543 billion. These numbers fluctuate often with stock prices, and should be taken with a grain of salt.

—

9:30 a.m. ET: Stocks open higher in short session

Here were the main moves in markets as of 9:30 a.m. ET:

S&P 500 (^GSPC): 3,639.36, +9.71 (+0.27%)

Dow (^DJI): 29,937.39, +64.92 (+0.22%)

Nasdaq (^IXIC): 12,182.59, +88.19 (+0.73%)

Crude (CL=F): $45.26 per barrel, -$0.45 (-0.98%)

Gold (GC=F): $1,783.80 per ounce, -$27.40 (-1.51%)

10-year Treasury (^TNX): flat to yield 0.8590%

—

9:15 a.m. ET: Is Black Friday what it used to be?

The short answer is...no. COVID-19 is accelerating a trend that had already been underway for years — namely, online buying supplanting the ensuing mayhem in brick-and-mortar retail shops during Thanksgiving weekend.

New evidence of that comes from a Bloomberg report showing retail foot traffic tumbled 9% year over year last week, according to data from SafeGraph:

Off-price, with a drop of 22.8%, and malls, department stores and apparel, with a decrease of 21%, had the biggest declines among six categories tracked.

Nordstrom, with a 71.9% decline, and Victoria’s Secret, with a decrease of 44.3%, notched the biggest year-over-year drops among a selection of retailers tracked. Dollar General had the top year-over-year increase, at 22.3%, followed by ALDI, at 16.1%.

Meanwhile, a separate report forecasts that Amazon will get a whopping 42% of all online retail spending, according to Truist.

—

9:00 a.m. ET: Thanksgiving may be a COVID accelerator

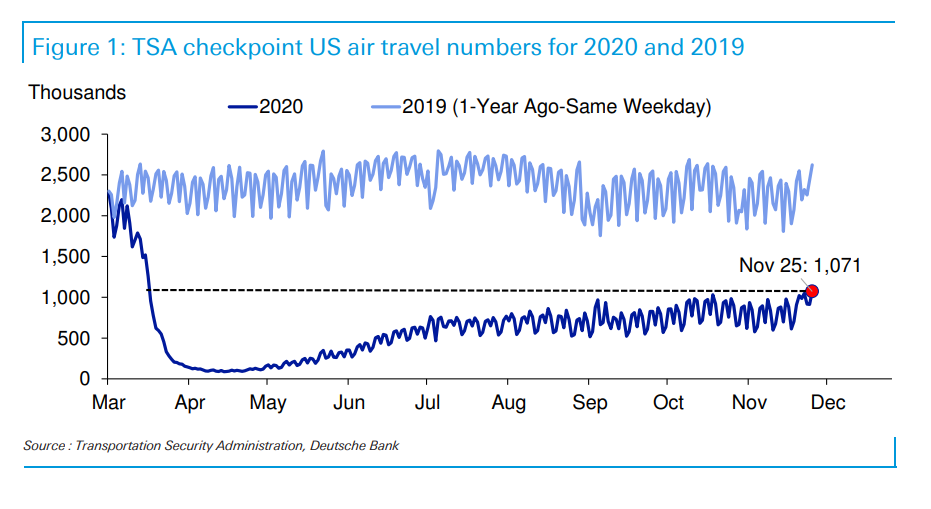

In the face of pleas from public health officials to avoid holiday weekend travel, Wednesday was in fact the busiest day at US airports since the start of the pandemic. The Transportation Security Administration screened over a million people on Thanksgiving eve.

Economists like Deutsche Bank’s Jim Reid are optimistic that normalcy will resume next year, but “it is quite clear that Thanksgiving and Christmas pose Covid super spreader event risk in various countries. Canada held Thanksgiving on October 12th and many public health officials there have blamed this for the recent spike in cases.”

—

7:30 a.m. ET Friday: Stock futures advance in thin trade

Here were the main moves in equity markets, as of 7:30 a.m. ET:

S&P 500 futures (ES=F): 3,635.00, +7.75 (+0.21%)

Dow futures (YM=F): 29,882.00, +54.00( +0.18%)

Nasdaq futures (NQ=F): 12,197.75, +45.50 (+0.37%)

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay